Notes:

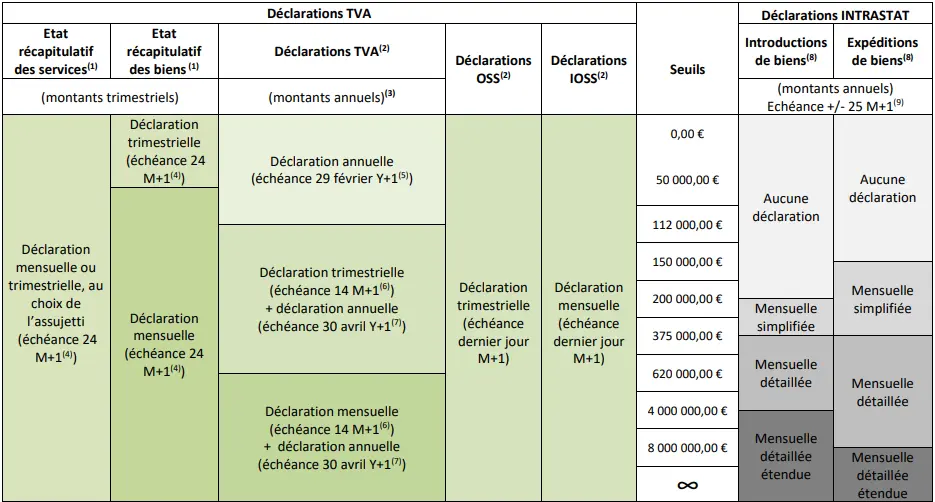

Since 1 January 2020, all VAT returns and summary statements must be filed electronically. Paper filing is no longer permitted.

- Filing a “nil” summary statement for goods or services is not required for periods without activity.

- Filing a “nil” declaration is required for periods without activity.

- The amounts to be taken into account for determining the frequency of VAT returns include the annual turnover, or the amount of intra-Community acquisitions of goods and services received from abroad, depending on which amount is the greater (exception: if the taxable person provides services rendered electronically).

- In practice, no fine applies if the return is filed no later than +/- 18 M+2. However, failure to comply with the deadline of 24 M+1 for the summary statement for deliveries of goods may result in the exemption provided for in Article 43.1.d of the Luxembourg VAT Law being called into question. The same applies when the summary statement for deliveries of goods does not contain the correct information, unless the supplier can duly justify his failure

- In practice, no fine applies if the declaration is filed by 31 October Y+1 at the latest, but the payment of an interim payment will most likely be requested by the administration at the end of the first half-year

- In practice, no fine applies if the declaration is filed by 14 M+3 at the latest

- In practice, no fine applies if the declaration is filed by 31 December Y+1 at the latest

- The filing of an INTRASTAT “nil” declaration is required for periods without activities, as long as the threshold for filing INTRASTAT declarations has been exceeded

- The declaration must be filed by the 15th working day M+1 at the latest

Discover our services

VAT solutions offers various services to assist you with your VAT issues in Luxembourg and internationally:

- Diagnosis of your VAT organization, your flows and the methods of retaining proof of exempt transactions; measurement of the impact of the new VAT rules;

- Confirmation of the VAT treatment of your flows;

- Coaching/training;

- Support for VAT obligations in Luxembourg and abroad: assistance, preparation and filing of VAT identification applications and VAT returns.

Contact us

Phone number: +352 26 945 944

Mail: info@vat-solutions.com

And for more content, check out our LinkedIn page here.