Reminder on the right to deduct VAT on imports

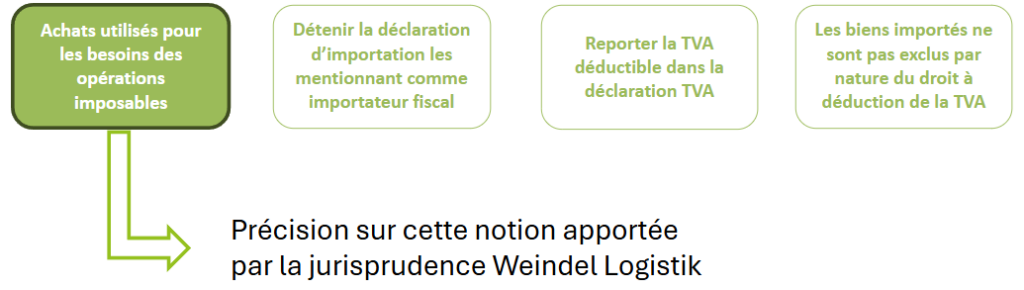

Article 271 of the CGI sets out the substantive and formal conditions for the implementation of the right to deduct VAT on imports.

Article 271 II 1-b) of the CGI: To the extent that goods and services are used for the needs of their taxable operations, and on the condition that these operations give rise to a right to deduction, the tax which the taxpayers can deduct is (…) that which is paid by the taxpayers themselves for imports (…)

CJEU 08/10/2020 Case C-621/19 known as the Weindel Case: Article 168(e) of Directive 2006/112/EC [transposed into Article 271 II 1-b) of the CGI] must be interpreted as precluding the granting of a right to deduct value added tax (VAT) to an importer where he does not have the goods in the same way as an owner and where the upstream import costs are non-existent or are not incorporated in the price of the particular downstream operations, or in the price of the goods and services supplied by the taxable person in the context of his economic activities.

This latter condition poses a problem for French manufacturers who import goods into France for processing from third countries and which they do not own.

Problems encountered by manufacturers

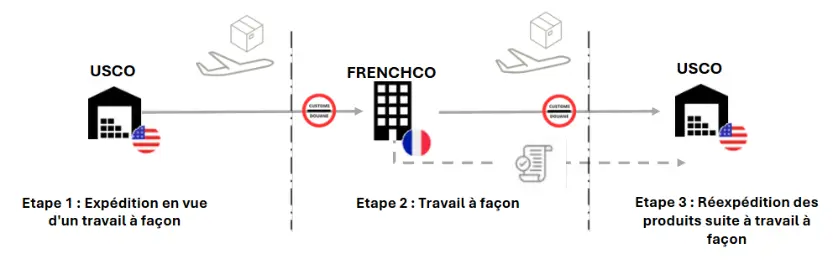

Example of the company USCO and FRENCHCO: The company USCO established in the United States ships products for custom work to the company FRENCHCO, which is established and identified for VAT in France.

FRENCHCO reships the products after custom work to the United States.

USCO remains the owner of the products throughout the cycle and the invoices issued by FRENCHCO therefore only covered the processing services, not the imported goods.

Problem: FRENCHCO is not entitled to deduct the VAT paid on importation, which can represent a significant financial cost.

VAT solutions for imports by French manufacturers

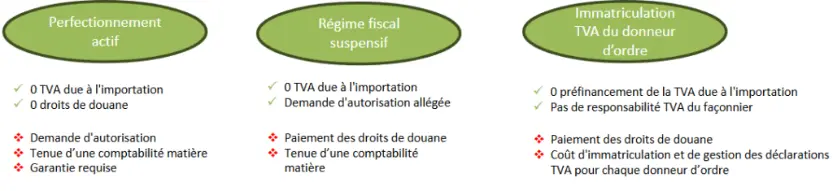

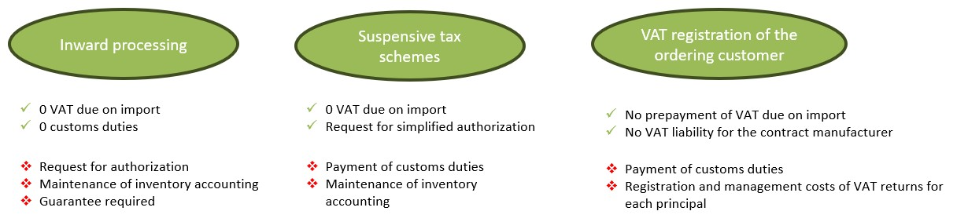

Active improvement, suspensive tax regime and VAT registration

Until now, in response to this problem, three unsatisfactory solutions coexisted: active improvement, the suspensive tax regime and the VAT registration of the principal.

New VAT solution with the import tax mandate since January 1, 2025

Since January 1, 2025, the new article 289 A bis of the CGI allows companies neither established nor identified for VAT in France to appoint a tax agent for imports, to fulfill their VAT obligations in France.

Examples: VAT declaration, VAT payment, VAT deduction or refund, record keeping.

This regime applies to the following operations:

- Imports for which VAT is fully deductible

- Exports and similar operations (in accordance with article 262 of the CGI).

- Operations carried out under suspensive customs and tax regimes, resulting in the export of goods.

- Imports which have been the subject of one or more deliveries under these same suspensive customs and tax regimes.

Therefore, contractors who import goods for contract processing and then re-export the goods can benefit from this system.

To do this, the non-European client must mandate its French contractor to establish its VAT tax obligations in its name and on its behalf.

The manufacturer must request a specific identification number from its SIE (separate from its standard VAT number) to declare the operations of non-European companies thus represented, then inform its SIE of each mandate thus conferred on it.

The French manufacturer will be able to collect and deduct import VAT simultaneously on the VAT declaration established on behalf of the non-European company.

Which solution should I use?

The import tax mandate represents a real opportunity for French manufacturers who import goods from third countries for processing.

This solution allows you to deduct VAT on imports and eliminates any financial risk.

However, active processing and the suspensive tax regime remain solutions to be considered, particularly when import customs duties are at stake.

Implementation of the import tax mandate by manufacturers

Manufacturers who wish to set up the import tax mandate must follow the following process:

Step 1: Identify the relevant clients

Step 2: Check eligibility for setting up the import tax mandate (Conditions relating to the mandate, agents and operations covered)

Step 4: Establishing a mandate with the principals

Step 4: Request for VAT identification from the SIE

Step 5: Filing of VAT returns to declare imports/exports made in France by the non-European client

Discover our services

VAT solutions offers various services to assist you with your VAT issues in France and internationally:

- Diagnosis of your VAT organization, your flows and the methods of retaining proof of exempt transactions, measurement of the impact of the new VAT rules;

- Confirmation of the VAT treatment of your flows;

- Coaching/training;

- Support for VAT obligations in Luxembourg and abroad: assistance, preparation and filing of VAT identification applications and VAT returns.

Contact us

Phone number: + 33 6 12 37 32 22

Email: info.fr@vat-solutions.com

And for more content, check out our LinkedIn page here.