New VAT 2025: elimination of one-off tax representation in France

The 2025 Finance Act repeals the tax representation regime provided for in Article 289 A III of the CGI.

Freight forwarders and logisticians will no longer be able to act as ad hoc tax representatives to declare exempt imports into France (regime 42) of non-European companies from their own VAT number (dedicated to ad hoc tax representation).

This requires non-European companies to appoint a traditional VAT tax representative as soon as possible (except in exempt territories), to register for VAT in France and to file French VAT returns.

In fact, the new tax agent regime of article 289A bis does not cover the scope of imports under regime 42.

Important information: By a VAT tax ruling dated 14 May 2025, the tax authorities granted an exceptional extension of the one-off tax representation mechanism until 31 December 2025. Consequently, the VAT registration numbers of the one-off tax representatives of the operators concerned remain valid until 31 December 2025.

One-off tax representatives must use this period to ensure VAT compliance of their non-European clients with the new regulations (setting up tax representations).

Reminder on imports under regime 42 by non-European companies and the one-off tax representation regime

Principle of imports under regime 42

Regime 42 corresponds to the implementation at the customs level of the VAT exemption on imports provided for in article 291 III 4° of the CGI

Importation is exempt from VAT if four cumulative conditions are met:

Physical flow of goods: The goods are shipped from a third country of the EU or a territory with special status (Example: DROM COM in France) and are introduced and cleared through customs in Metropolitan France

Delivery exempt in another Member State: Imported goods are delivered to a taxable person in another EU Member State (exempt intra-Community delivery) either as part of a sale or as part of a transfer to oneself (similar to a sale)

French VAT number of the buyer or importer: At the time of importation, you must have the French VAT number of the importer or the valid VAT number of the buyer or importer, issued by a Member State other than France

Immediate delivery: Shipment to the other Member State must immediately follow importation

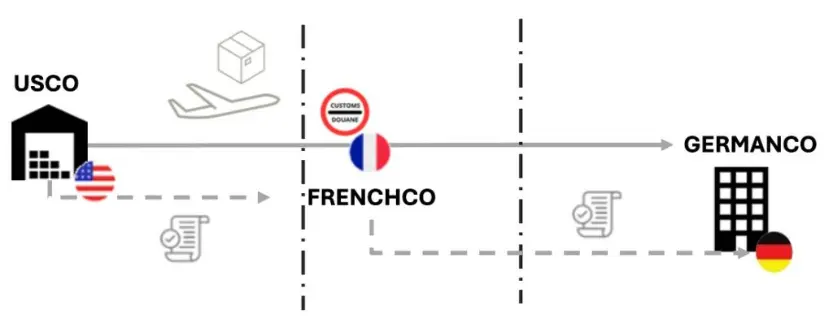

Import under regime 42 by a non-European company until December 31, 2024

A non-European company imports goods into France which are then delivered intra-Community to its taxable customer in Germany.

Importation into France is exempt from VAT in France if the conditions detailed above are met.

However, as soon as it carries out taxable transactions in France, USCO has VAT reporting obligations in France.

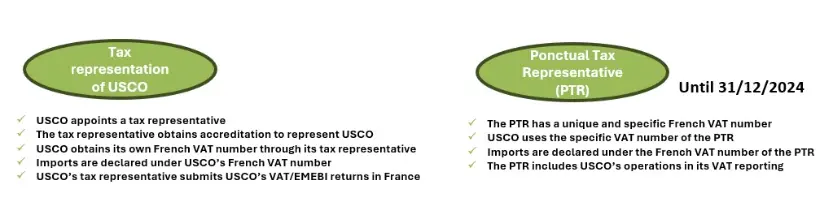

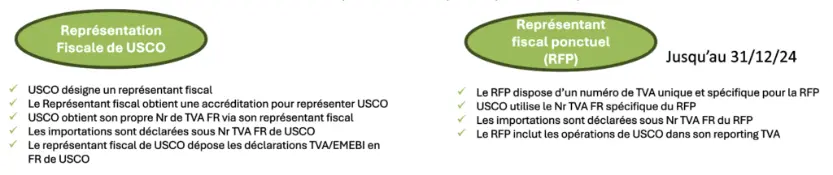

Until January 1 , 2025, several options existed to postpone these operations:

Import under regime 42 by a non-European company since January 1 , 2025

The one-off tax representation regime has been abolished. Therefore, in theory, it is no longer possible to use this option since 1 January 2025.

The non-European company must therefore appoint a tax representative (unless it is established in certain countries and territories – see our tax representation page ).

The tax representative obtains accreditation to represent the non-European company for tax purposes.

The non-European company obtains a VAT number in France.

The VAT tax representative declares the imports as well as the subsequent intra-Community delivery under the French VAT number of the non-European company.

The VAT tax representative files the VAT/EMEBI declarations in France for the non-European company.

Loss of VAT interest from regime 42 on imports in VAT matters

Generalization of VAT on imports (import under regime 40)

In 2022, the generalization of self-liquidation of VAT on imports has led to a loss of interest in imports under regime 42.

In fact, the main interest of regime 42 is the exemption from VAT on the importation of imported goods which are the subject of a subsequent exempt intra-Community delivery.

However, since the generalization of self-liquidation of VAT on imports on January 1, 2022 , companies no longer pay customs VAT for their imports under regime 40.

They collect and deduct import VAT simultaneously on the French VAT return.

"By allowing the simultaneous collection and deduction of VAT on imports, imports under regime 40 become tax neutral for businesses, neutralizing the attractiveness of the VAT exemption of regime 42 on imports."

The only remaining problem – not the least – concerns companies not established in France and particularly non-European companies.

Indeed, the generalization of self-assessment of VAT on imports requires foreign companies to register for VAT in France in order to declare the VAT due on their imports. For non-European companies, this also requires appointing a VAT tax representative.

Given this constraint, some companies still preferred to use customs regime 42 for their imports followed by an exempt intra-Community delivery. This allowed them to avoid obtaining their own VAT number by appointing a VAT tax representative (more administratively burdensome) and to appoint, for example, their freight forwarder as a one-off tax representative.

Repeal of the one-off tax representation regime for imports under regime 42

The 2025 Finance Act repeals the tax representation regime provided for in Article 289 A III of the CGI.

Consequently, non-European companies that carry out imports followed by an intra-Community delivery under a 42 regime must now appoint a VAT tax representative (unless they are established in certain specific territories and countries) and have a VAT number in France.

'Whether for their imports followed by an intra-community delivery under regime 40 or regime 42 in France, non-European companies must now register for VAT in France and, for the majority of them, appoint a tax representative.''

Maintenance of the one-off tax mandate regime for imports under regime 42 carried out by operators established in the European Union

Article 95 B of Annex III of the CGI has not been repealed.

This system allows taxable persons established in another EU Member State to appoint a one-off tax agent without needing to register for VAT in France when they exclusively carry out certain transactions.

The operations are as follows:

- imports under regime 42 of goods exempt from VAT pursuant to 4° of III of article 291 of the CGI , i.e. when the goods imported into France are, immediately after importation, the subject, by the importing taxable person, of an intra-community delivery itself exempt from VAT.

- withdrawals of goods from a regime or a suspensive tax warehouse or a Community customs regime pursuant to 1 of II of Article 277 A of the CGI , for which the person liable for the tax is exempt from payment pursuant to 4 of II of the same article, i.e. when the goods are the subject, immediately after leaving the regime, of an export or an intra-Community delivery itself exempt from the tax; The occasional tax agent then files a quarterly statement of the operations carried out by his mandates as well as the VAT summary statements.

"The one-off tax mandate is maintained. Nothing changes for European companies that import goods under regime 42 via a one-off tax agent in France."

Discover our services

VAT solutions offers various services to assist you with your VAT issues in France and internationally:

- Diagnosis of your VAT organization, your flows and the methods of retaining proof of exempt transactions, measurement of the impact of the new VAT rules;

- Confirmation of the VAT treatment of your flows;

- Coaching/training;

- Support for VAT obligations in Luxembourg and abroad: assistance, preparation and filing of VAT identification applications and VAT returns.

Contact us

Phone number: + 33 6 12 37 32 22

Mail: info.fr@vat-solutions.com

And for more content, check out our LinkedIn page here.