France – VAT reverse charge for imports in 2024

France – VAT reverse charge for imports in 2024

Elimination of the option to pay VAT at customs, mandatory VAT reverse charge for imports, risks, common errors, penalties, and regularization. Discover our 2024 Import VAT Guide.

Import VAT reform in 2022

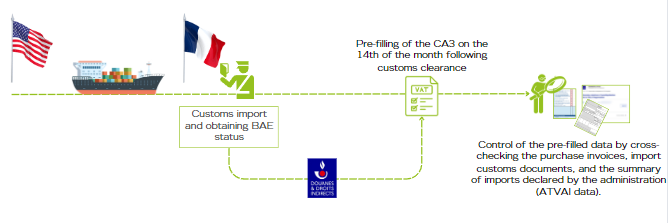

Following the transfer of responsibilities for the collection of import VAT between the DGDDI and the DGFIP, the payment of VAT at customs has been prohibited (except for individuals), and VAT reverse charge for imports has become mandatory for businesses. This means that companies must simultaneously collect and deduct import VAT on their French VAT return (CA3), and therefore must be registered for French VAT at the time of importation.

To support this change, the tax administration has implemented a pre-filling of the VAT declaration for taxable imports. However, businesses must manually enter the deductible VAT for these operations, ensuring they comply with the formal and substantive conditions for the right to deduction.

At this stage, non-taxable imports are not pre-filled on the VAT declaration and must be declared manually. This applies, for example, to dentists or dental technicians importing VAT-exempt dental prostheses, or to companies and public bodies registered for VAT importing blood or organs under VAT exemption.

By 2024, it is expected that pre-filling will be introduced for these non-taxable imports.

Important: The information declared remains the responsibility of the VAT taxpayer. This means that companies must verify the pre-filled data. To assist with this, the customs administration has provided the ‘ATVAI Data’ service, allowing businesses to view all imports during a given reporting period.

Learn about the imports covered by this system, the values to declare, the reporting periods, and the appropriate methodology.

Detecting an import

According to Article 291 I 2° of the French General Tax Code, an import subject to VAT occurs when three cumulative conditions are met:

– The goods are introduced into the European VAT territory from a non-EU country.

– Before being introduced into the European VAT territory, the goods are not in free circulation, meaning they have ‘non-Union’ customs status.

– In the European VAT territory, the goods are neither awaiting assignment to a customs procedure nor placed under one of the following special customs regimes: external transit, storage (warehouse or free zone), inward processing, or temporary admission with total exemption from customs duties.

This applies in particular when a company carries out:

– Purchases of goods from a non-EU country or from French overseas territories (DOM/TOM) and imports them to France.

– Imports of samples or free goods from a non-EU country or DOM/TOM and imports them to France.

– Returns of stock held in a non-EU country or in the DOM/TOM.

– Returns of goods that were previously exported permanently.

Conversely, the following operations should not be considered as imports:

– Purchases of goods from a non-EU country or from the DOM/TOM under a DDP incoterm (Delivered Duty Paid), where the company is not designated as the importer on the import declaration.

– Purchases of goods from a non-EU country or DOM/TOM that have been customs-cleared in another EU country before being introduced to France.

These specific cases require a thorough regulatory analysis by VAT specialists.

When to declare VAT due on imports

According to Article 293 A of the French General Tax Code and the Union Customs Code, VAT is due on imports at the time the goods are released for free circulation or temporarily admitted with partial exemption from import duties.

In practice, this corresponds to the month in which the release note (‘bon à enlever’ or BAE) is obtained.

Note – This means the VAT declaration should be based on the customs clearance date, not the invoice date from the supplier. This distinction can have significant implications.

Example: A company imports goods from the United States. The U.S. supplier issues the invoice in April. The goods are cleared in May. VAT is not due in April, but in May. This transaction should therefore be declared in June, on the VAT return for May.

What value to declare on goods imports

The taxable base for VAT due on imports consists of the customs value, to which the following must be added:

– Taxes, duties, levies, and other charges due because of the import, excluding VAT itself (e.g., customs duties).

– Ancillary costs, such as commissions, packaging, transportation, and insurance costs incurred until the first destination within the country or incurred for transportation to another destination within the European Union if known at the time the tax is triggered.

Conversely, the following should not be included in the taxable base:

– Discounts, rebates, and other price reductions granted at the time of import. In practice, this means price reductions shown on the invoice submitted with the customs declaration are accepted at the time of import.

Note – This means imports should not be declared on the VAT return based on the amounts shown on supplier invoices. It is essential to request customs or import documents from your freight forwarder to declare the customs value on the VAT return. The customs value will not match the supplier’s invoice amount.

Where to declare goods imports

Taxable imports must be declared as follows:

– Taxable base on line A4.

– VAT due on lines I1 to I6, depending on the applicable VAT rate.

– Deductible VAT on lines 19 or 20 and on line 24.

Non-taxable imports must be reported on line E4.

Note – Companies benefiting from a VAT exemption quota based on Article 275 of the French General Tax Code must report their imports on line F6.

Petroleum products and goods under special customs regimes are subject to specific regulations and reporting methods.

How to verify the data pre-filled by the tax administration?

To verify the pre-filled data on your VAT return, you must:

- Have an ATVAI account

This service provides import VAT payers with certain customs data to verify the amounts pre-filled on the French VAT declaration for a given period.

To find out how to create an account and obtain authorizations, click here or contact us.

By checking these pre-filled data, you can ensure that no import has been omitted or added for a given reference period.

- Request customs documents from your freight forwarder or courier (import SAD) or import summaries

Customs documents or import summaries are necessary for several reasons:

First, they allow you to verify that the import has been recorded in the “ATVAI Data” service.

Next, they help ensure that the import is assigned to the correct reporting period based on the date the BAE status was obtained. This will also help ensure that no import was omitted during a period.

Finally, these documents will show the customs value of the import (box 47), which must be compiled with all the customs values of imports for the reporting period to determine if the amount matches the pre-filled amount by the tax administration.

Lastly, the right to deduct import VAT that has been reverse charged is exercised based on the customs declaration where the company is listed as the importer in box 8 or box 44.

- Have supplier invoices for billed goods or proforma invoices for unpaid goods

The invoices and proforma documents will help ensure that all imports of goods, whether financial transactions occurred or not, have been declared for a given period.

Common errors to detect when checking pre-filled data

Date of liability

Case: The company uses supplier invoices to determine the reporting period for the transaction.

Resolution: As stated earlier, import VAT is due when the BAE is obtained at customs clearance, which does not coincide with the supplier’s invoicing date. Therefore, by using the invoice instead of the customs document, a company may wrongly include imports in a period or attempt to remove certain imports.

Taxable base

Case: The company uses supplier invoices to compile the amounts of imports and determine the reporting period for the transaction. As mentioned earlier, VAT is due on the customs value, which always differs from the value shown on the supplier’s invoice.

Resolution: As a result, even if a company includes all the imports from a transaction, by not using the correct amount, the total compiled import value will not match the amounts pre-filled by the administration.

Operations to declare

Case: The company does not declare samples sent by its supplier from a non-EU country.

Resolution: All operations that meet the definition of imports (see above) must be subject to reverse charge VAT on imports. This also applies, for example, to returns of goods or imports of samples.

Imports with VAT exemption quota.

Case: The company uses a VAT exemption quota and reverse charges VAT on imports on line A4 and partially as deductible VAT on its declaration.Resolution: When a company has a VAT exemption quota under Article 275 of the French General Tax Code, it can import goods without paying import VAT. These transactions must be declared on line F6 of the French VAT declaration. No VAT should be collected or deducted for this transaction.

Two possible outcomes after data verification:

– Either the amount matches the pre-filled amount from the tax administration.

– Or the amount does not match, in which case corrections or regularization must be made.

Note: This mechanism was quite commonly used before 2022 to avoid the pre-financing of import VAT under certain conditions. With the generalization of reverse charge VAT on imports in 2022, this mechanism has lost its relevance and is used less frequently in practice.

Corrections and regularizations

For corrections made before the 24th of the month following the VAT liability (submission deadline), the company must make the changes directly on the VAT return by adjusting the taxable base, collected VAT, and deductible VAT for the transaction.

For corrections made after the submission deadline, the company must:

– Either file a corrective VAT return for the reference period (which will cancel and replace the initially validated VAT return).

– Or complete the fields dedicated to regularizations on a VAT return for a later period.

To learn more about regularization methods, clarifications are provided in the guide on the main regularization cases or in the official customs bulletin regarding the new rules for implementing reverse charge VAT on imports as of January 1, 2022.

Penalties and fines

In the event of a tax audit, failure to reverse charge VAT on imports is subject to a fine of 5% of the deductible amount (Article 1788 A of the French General Tax Code), in addition to regular fines and penalties.

If a transaction was incorrectly reverse charged, the administration may challenge the right to deduct the reverse charged VAT.

Other useful links

– The administration provides a FAQ addressing common issues faced by companies: here

– Access the “ATVAI Data” service: here

– Agreement and authorization for the online “ATVAI Data” service: here

– Explanatory note for the agreement and authorization for the online “ATVAI Data” service: here

Discover our services

VAT Solutions offers a range of services to assist you with your VAT-related challenges in France and internationally:

– Diagnostic of your VAT organization, your flows, and the methods for preserving proof of exempt operations, as well as assessing the impact of new VAT rules;

– Confirmation of the VAT treatment of your flows;

– Coaching/training;

– Management of VAT obligations in Luxembourg and abroad: assistance, preparation, and submission of VAT identification requests and VAT returns.

Contact us

Phone number: + 33 6 12 37 32 22

Email: info.fr@vat-solutions.com

For more content, check out our LinkedIn page here.

By agreeing, we’ll assume that you are satisfied with our use of cookies on your device.

If you continue navigating, we’ll assume that you are happy to receive all cookies from our website.

Otherwise, you can change your settings at any time.

En acceptant, nous supposerons que vous êtes satisfait de notre utilisation des cookies.

Si vous continuez à naviguer, nous supposerons que vous acceptez de recevoir l’ensemble des cookies de notre site web.

Sinon, vous pouvez modifier vos paramètres à tout moment.